📑 Sommaire

Presentation of the property

We have identified a lot of 16 garages for sale. To invest in a lot of garages, you must ask the seller for a copy of the current rental contracts to check the amount of rent received but also the exact number of garages rented. Considering the exceptional geographical situation of this property, near a large city. We know that a rent around $ 93 per month and per garage is not crazy. There are few garages for rent at the moment, but you shouldn’t overestimate the rents. The income indicated by the seller of $ 1500 per month is realistic. The property tax for a 7 276 sq ft plot of land is in line with the averages observed in this sector.

The photos reveal a fibrocement roof that may contain asbestos. This is a negative point that could lead to major work for the buyer in the coming years.

Have you noticed how the seller places foot calls in his ad ? Building land in the city centre, possibility to build a house or loft…. We will study the profitability and tell you what the seller really has in mind. The elements of some ads show the intentions of the sellers. Learning to discover what is hidden between the lines saves valuable time for experienced investors. Why should an investor who wishes to buy a lot of garages not position himself on this property ?

Profitability analysis, value of the lot of garages for sale

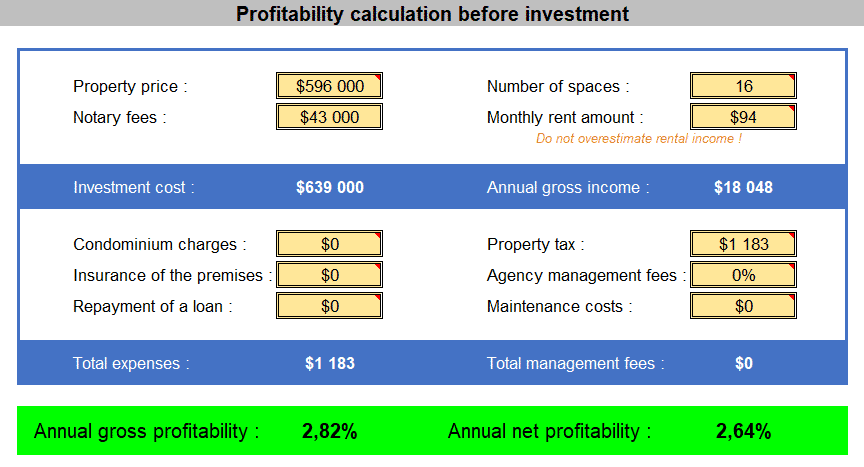

The selling price displayed is $ 596 000 excluding notary fees. We take the amount of the annual income of $ 18 000 given by the seller. The annual gross profitability is 2.82%. We will not comment. As usual, we do not take into account income taxes, which vary according to your tax rate. Remember to purchase non-occupant homeowner’s insurance to get the right rate. You can also create an society to optimize your tax situation.

📈📊📉 REAL ESTATE BAROMETER 📉📊📈

car park, garage, box, cellar, warehouse, shed, container, premises, shop

Geographical location is the most important criterion for buying a profitable car park, garage, cellar or warehouse. If you score below 40, we advise you not to waste too much time on this property unless the price is very attractive. The risk factor is greater.

The parking barometer indicates a score of 41 for this lot of garages if we do not take into account the displayed rate. Including the result of the profitability calculation, the score increases to 34 and the good is in the amber category. The conclusion of the barometer is clear : the lot of garages is interesting as long as it is in the market price.

A plot of land for promoters or developers

With only 2.63% net, profitability is really not very good! Slightly higher than a home savings plan (PEL), it is better to leave your money in the bank. Roof repairs will even cost you money. But why does the seller set such a high price and show such a low profitability ?

The seller’s positioning is clear, this announcement does not absolutely target traditional garage investors. The target is developers and real estate developers who will raze the garages to exploit the land. A developer gets a good return on investment if he divides the 7 276 sq ft by selling 3 serviced plots. On the developer side, profitability is much higher. He can build a building with many apartments on 7 276 sq ft and resell new apartments at a good price. The price asked by the seller of $ 636 000 with notary fees. The desired price is $ 940 per square meter, knowing that the average price of a bare land in this area is around $ 500 per square meter. The seller knows that a developer will pay the price to build a building in the city centre.

💡 Did you know that : A property developer can buy up to 3 times the value of a plot of land to build a building in the heart of a major city.

The profits generated by the sale of several flats following the construction of a building explain this increase in value.

Advantages and disadvantages

| CRITERIA | 😉 ADVANTAGES 👍 | 👎 DISADVANTAGES 🤨 |

|---|---|---|

| Location | A very good geographical location | |

| Maintenance | Asbestos cement roofs may contain asbestos and require major work | |

| Safety | Homes provide part of the security of the site | |

| Profit | Virtually no return, the term investor is poorly chosen in the advert | |

| Potential | At the price indicated, it will be virtually impossible to achieve positive cash flow. |

Our conclusion

This lot of garages is the perfect example to explain to you that you shouldn’t focus too much on properties with a profitability disconnected from market prices. In this case, the posted price is calculated to sell to a real estate developer, you will have no chance to negotiate the price to operate the garages. This lot must be kept in mind if within two years no developer has positioned himself, the seller will change target and propose an adapted rate with a rental profitability around 8 to 10% gross.

Join the 4000 subscribers to our newsletter !