Becoming a real estate annuitant is the dream of many people. Today we present you with a set of garages that can allow you to drop your work ! The package presented to you offers the possibility of generating $ 5 000 in gross income per month. With a gross income of $ 60 000 per year, there is enough to stop working and live comfortably on your pensions.

The ratio between total gross income and net income is interesting because the expenses are low. Discover the profitability study of this lot of garages and became maybe a real estate annuitant.

📑 Table of contents

How much money does it take to become an annuitant

Becoming an annuitant is getting enough passive income to stop working. Living on your pension is the dream of many people, but very few achieve this result. For example, among the hundred or so members of the club, only three live exclusively on their rental income.

It’s incredible how many annuitants you can find on the internet. This term has become popular in the last 5 years to sell you a dream. Anyone can consider themselves an annuitant, even someone who earns only $ 1 000 per month. A real estate rentier is above all a person in debt who has to repay many loans, unless your real estate assets come from an inheritance.

The important thing is to define the monthly income you need to live happily and enjoy yourself. The lot presented below gives a gross rental income of $ 60 000 per year. Of course, it is necessary to deduct from this income the repayments of the credit necessary to buy this property as well as the various taxes. You may not be an annuitant with this lot of garages but it will be an excellent complement of income!

A lot of garages for sale

An exceptional lot consisting of 85 boxes, garages and secure car parks in the heart of a big city. The complex includes 80 garages and parking spaces located outside but secured within the lot. An automatic portal with configurable code manages tenant access. A video surveillance system ensures the security of the premises. The roof of all the garages is redone in steel sheet type tray. There is no fibro cement roof, which guarantees the investor a great serenity on the construction side. The condition of the garage lot is perfect !

💡 Did you know that : Fibro cement roofing is a nightmare for investors. The cost of repair is very high if the roof contains asbestos. A fibro cement roof scares off 1 in 2 buyers !

Sale reason

The owner of the garage lot is a real estate company composed of two partners. The first is retired, 67 years old and lives 121 400 feets from the garage lot. Her 93 year old mother also lives a long way away. The main reason for the sale is the desire to get more time for travel. He’s actually a real estate annuitant and sell garages and houses. Indeed, a lot of 85 garages does not manage itself, even if the rental management remains basic, it must be given time.

The owners have different sources of income and this lot of garages requires them to travel regularly to the site to welcome tenants.

A sale by transfer of company shares

The sale by transfer of shares in company does not seem to you to be practices very often. Don’t get me wrong, fiscally speaking, it is sometimes interesting to take over shares in a existing company.

This method allows the seller to pay a little less tax during the transfer. The capital gain on a property is calculated by taking into account the purchase price and the resale price. Each partner must pay tax on capital gains on real estate based on the shares held in the company. Since February 1, 2012, the tax on capital gains on real estate is set at 19 % of the amount of the sale price less the purchase price. An additional tax is added if the capital gain is greater than $ 50 000, it is between 2 and 6 % of the amount of the capital gain.

In our case, the company use corporate tax). The gain recognized is subject to the progressive scale of income tax, with, however, the application of a deduction for the period during which it is held.

💡 Did you know that : To sell a property from a company without any risk, make sure that a “sale” clause is included in the company’s corporate purpose.

On the buyer’s side, there are many advantages :

- The real estate civil company already exists, you have no costs to set up a company and file the articles of association. However, remember to check that the existing company statutes are appropriate for your project.

- A faster purchase, the deed of transfer of shares of a company can be quickly drafted by a notary.

- Notary fees capped around $ 8 000 because they are securities to be sold.

- The value of a share is calculated in actual terms by taking into account the debts of the company. The value of the property must be added to the cash on hand in the company’s account and debts (interest, suppliers, maintenance costs) subtracted.

Yield analysis, rental income details

This batch of 80 garages obtains a score of 56 on the parking barometer, which confirms that this batch is very healthy. There is no work to be done !

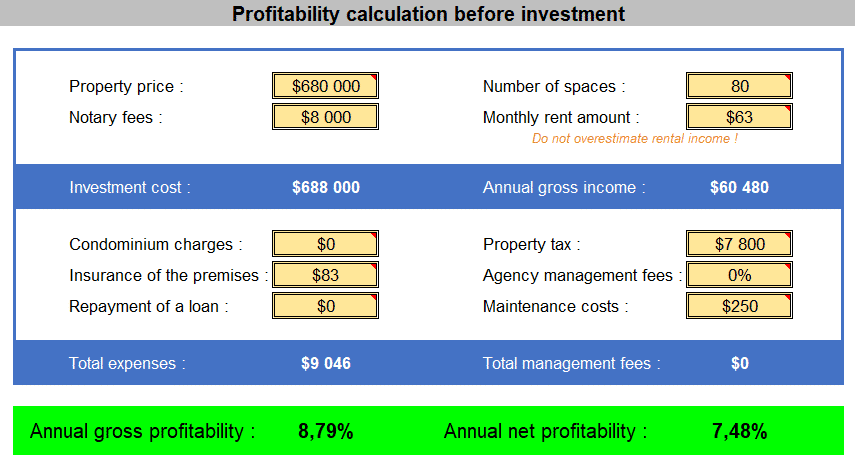

The gross monthly rental income is $ 5 000. The filling rate is constant and excellent : 97,5 % (out of 80 garages, 2 are currently vacant). Average rents are $ 62,5 per month and per pitch, there are different sizes of garages. The property tax is $ 7 800 in 2018. The insurance amounts to $ 1000 for the complete package, water, electricity and maintenance charges amount to $ 250 per year. There is even the possibility of making an accommodation on site. As usual, the profitability calculation table speaks for itself : 8,79 % gross.

📈📊📉 REAL ESTATE BAROMETER 📉📊📈

parking lot, garage, box, cellar, warehouse, shed, container, premises, shop

The indicator is green, the property you have located seems suitable. You must analyze in detail all the weak points of this property (geographical situation, security, obsolescence, profitability and ease of resale) in order to insist on them during the negotiation phase with the seller.

💡 Did you know that : The parking barometer is a tool that we have put in place incorporating some forty criteria to help you quickly assess the value of a site. Click here to download the simulator.

Become annuitant, invest in this lot of garages

The seller asks the club to make a pre-selection to avoid being disturbed by curious people. Indeed, to buy this lot of garages, the future owner must justify a minimum financial contribution of 35 % of the value of the lot or $ 230 000. The rest must be financed by a loan, with the precedence of company’s accounting, several banks will follow you in this project.

This lot of garages is a good investment that provides better returns than a traditional bank investment. You can invest for your children, use the money to become annuitant, invest an inheritance, etc… We simulated borrowing from a bank. For 10 to 15 years the property is self-financing and generates income for the owner, then it is the jackpot for another 10 to 15 years !

There is even the possibility of staying on site by building a private accommodation, the seller can take care of helping you if you want to live near the garages and be a real estate annuitant.

The transfer of the shares of the company can be made over 2 years, leaving the majority to the new owner. The seller will stay for 1 year to help you stabilize your investment before withdrawing. This lot is managed like a small business without too much constraint, interested then:

💰 Create and boost your passive income

Property news

1 mail per month

+5000 subscribers